So a decrease ratio will typically be thought of preferable to a higher ratio because it implies that a company is much less reliant on debt financing. And a high debt burden might spell bother if market conditions deteriorate, making it difficult for an organization to repay its loans. The debt-to-EBITDA ratio compares a company’s debt in opposition to the quantity of money circulate (EBITDA) it generates from business operations. Investors use it to know how much problem a enterprise would have in paying down its debts. Excessive debt-to-EBITDA may indicate that a company will have problem assembly its obligations.

Monetary leverage is essential because it creates opportunities for traders and companies. That opportunity comes with excessive risk for investors because leverage amplifies losses in downturns. Leverage creates more debt that might be hard to pay if the following years present slowdowns for businesses. You also can compare a company’s debt to how a lot revenue it generates in a given interval utilizing its Earnings Before Income Tax, Depreciation, and Amortization (EBITDA). The debt-to-EBITDA ratio signifies how much income is available to pay down debt before these working expenses are deducted from earnings. Startup technology firms might struggle to secure financing, and they should often turn to non-public investors.

How To Calculate Leverage Ratio

Lenders typically set debt-to-income limitations when households apply for mortgage loans. Completely Different industries require totally different monetary leverage, so it is inconceivable to tell if a monetary leverage figure is good or unhealthy with out evaluating it with its friends. For instance, consider a company that borrows $1 million at an interest rate of 5% to put cash into a project that returns 10%. If the project is successful, the corporate will earn $100,000 on its funding, pay $50,000 in interest, and thus web $50,000. Nevertheless, if the project solely returns 4%, the corporate will earn $40,000, pay $50,000 in curiosity, and incur a lack of $10,000. Construct a reusable spreadsheet that includes leverage, curiosity coverage, debt-to-equity, and extra, and use Wisesheets to maintain it reside and automated.

- The biggest risk companies take by doing that is the likelihood that the new property or projects won’t generate enough returns to cowl the loan payments.

- Nevertheless, if the plant fails to generate expected returns for whatever reasons, the corporate may battle to satisfy its loan obligations, and endure financially.

- Although the amount of debt helps build capital, investors look extra at it as a liability.

- This ratio indicates the amount of leverage risk contained within an entity.

- Excessive reliance on debt financing may lead to a potential default and eventual chapter in the worst-case scenario.

- Primarily, leverage adds danger, but it also creates a reward if things go nicely.

When corporations borrow money to spend cash on new assets, they hope that the profits they generate will cowl the worth of borrowing. The greatest threat firms take by doing this is the likelihood that the model new assets or initiatives won’t generate enough returns to cover the loan funds. This can damage the credit standing, in addition to the popularity of the company. When individuals and corporations use debt to finance investments, they are said to be using monetary leverage. They borrow funds to purchase assets with the expectation that the revenue or profit from the investment will be greater than the worth of interest and principal repayments. Ought To the borrower be unable to pay the interest or the loan quantity, it might possibly lead to monetary pressure, reputational damage, loss of belongings, and even bankruptcy.

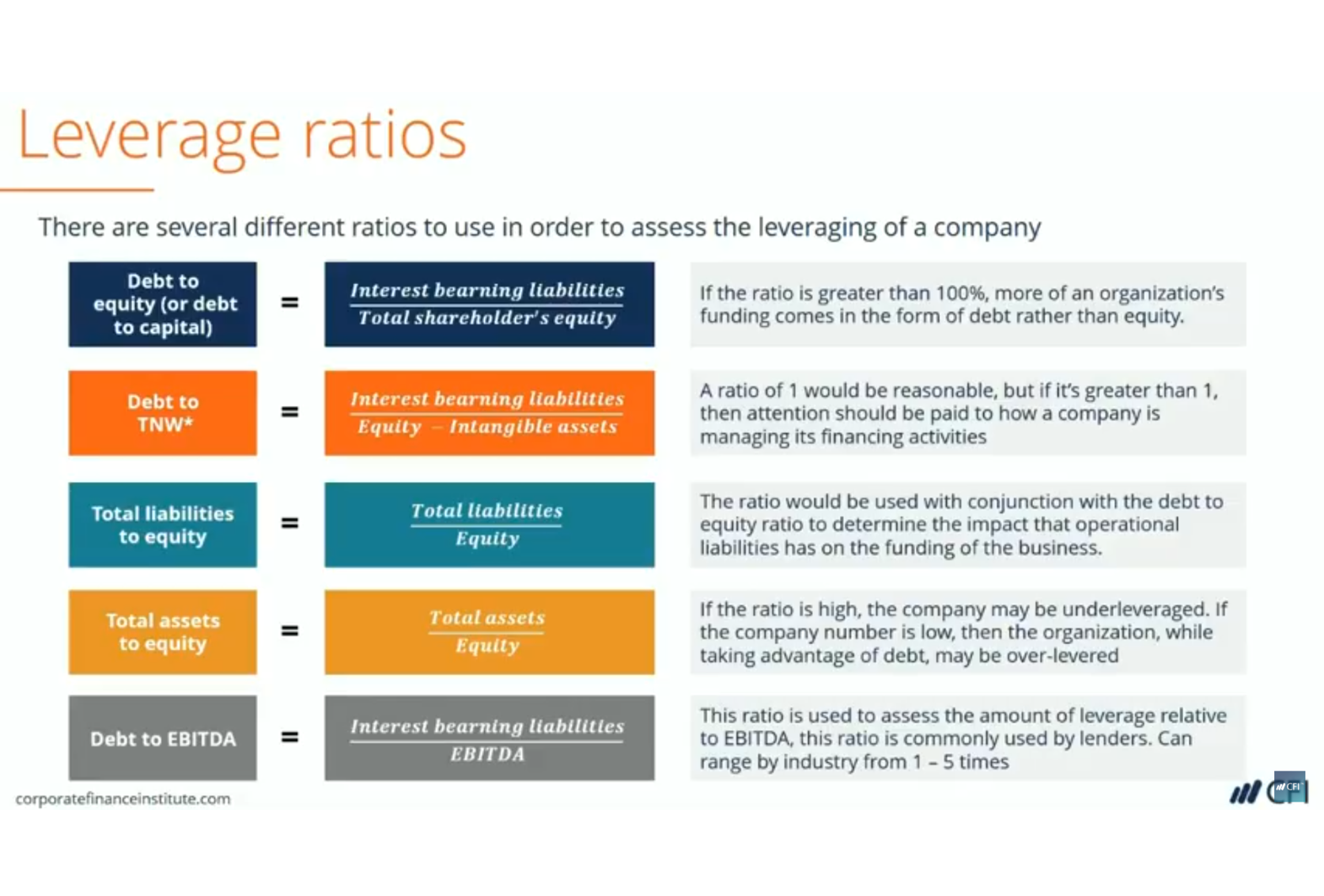

From 2021 to the end of 2025, the total leverage ratio increased from 4.0x to four.8x, the senior ratio increased from 3.0x to 3.6x, and the web debt ratio elevated from three.0x to 4.5x. Each of these measures, regardless of the cash circulate metric chosen, shows the number of years of operating earnings that may be required to filter all present debt. Right Here are some widespread leverage ratios, their formulas and when to use them. A excessive debt/equity ratio usually signifies that an organization has been aggressive in financing its development with debt. This can end result in risky earnings as a outcome of the extra curiosity expense.

Leverage Ratios In Mortgage Covenants

It can be alarming if the ratio is over 3.0, however this can differ by trade. A D/E ratio larger than 2.0 sometimes signifies a risky situation for an investor, but this yardstick can vary by trade. Businesses that require large capital expenditures (CapEx), such as utility and manufacturing corporations, might have to secure extra loans than other firms.

Why Business Context Is Necessary

One of the most typical ways is the financial leverage ratio, sometimes known as the fairness multiplier. Banks use leverage ratios to estimate the amount of debt the borrower firm has already borrowed as in comparability with fairness. Banks have a better willingness to provide loans to businesses with low leverage ratios. Firms with a high working leverage ratio, have greater mounted costs as in comparison with variable prices and are thought of capital intensive. In such business corporations, a small change in sales will bring about a large change in working income.

For instance, an organization may be comfortable in a high monetary leverage situation when it is extremely profitable. Still, it might be disastrous if the performance https://www.simple-accounting.org/ of the company starts to decline in the future. On the flip aspect, the airline business often suffers from the adverse impacts of leverage.

To perform some credit score ratio analysis, alongside computing the monetary leverage ratio, the next is the income assertion data of our company. In practice, the financial leverage ratio is used to research the credit score threat of a potential borrower, most frequently by lenders. This is considered one of the most important leverage ratios as it reveals a company’s monetary liabilities in relation to its shareholder’s fairness. Excessive leverage ratios can point out a company is utilizing extreme debt to finance its operations.

Life and incapacity insurance coverage, annuities, and life insurance coverage with longterm care advantages are issued by The Northwestern Mutual Life Insurance Firm, Milwaukee, WI (NM). Longterm care insurance is issued by Northwestern Long Term Care Insurance Coverage Company, Milwaukee, WI, (NLTC) a subsidiary of NM. Investment brokerage services are supplied through Northwestern Mutual Funding Services, LLC (NMIS) a subsidiary of NM, brokerdealer, registered funding advisor, and member FINRA and SIPC. Investment advisory and trust companies are offered by way of Northwestern Mutual Wealth Management Firm (NMWMC), Milwaukee, WI, a subsidiary of NM and a federal savings bank. Products and services referenced are provided and sold only by appropriately appointed and licensed entities and monetary advisors and professionals.